Much has been made of the late January equity swoon and whether the bounce from the Feb 9 lows is sustainable.

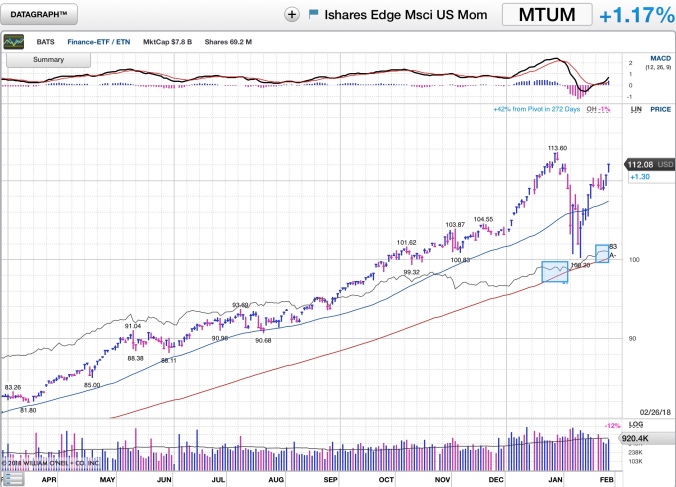

From the rising 200day moving average and the overnight S&P500 futures lows from the previous Monday night equities have rallied sharply.

Since then, almost immediately, the four key short term breadth indicators Barometer uses reversed up after the sharp declines that began as extremely overbought and finished as oversold. These include % of NYSE stocks trading above their 50 day moving Averages, % of NYSE stocks trading above their 150 day moving averages, % of NYSE equities with positive weekly price momentum and % of NYSE Equities hitting new highs vs. new lows. Barometer removed the futures hedges put in place January 30th on Feb 9th.

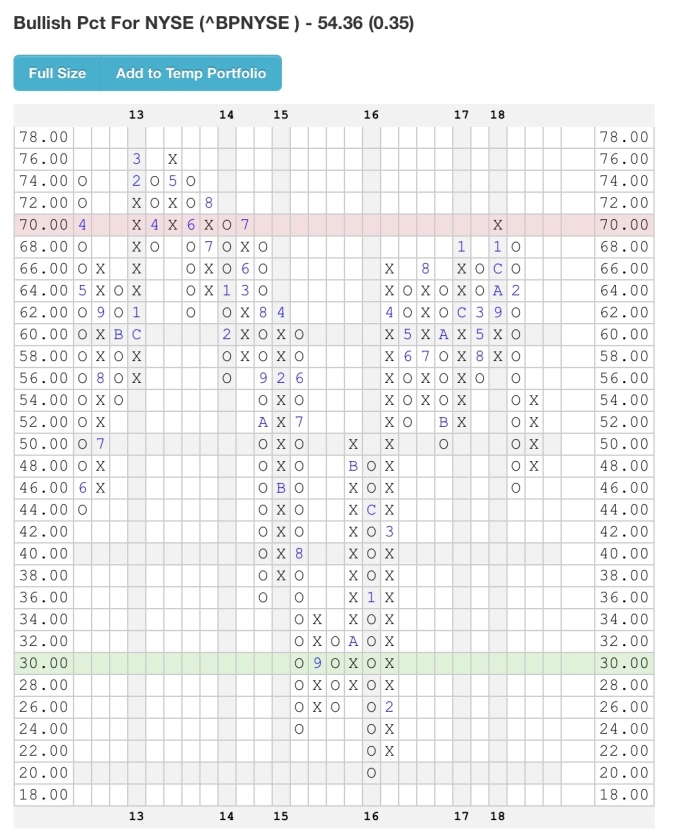

Almost immediately following the short term indicators positive reversal (improving breadth) our key long term indicator reversed back up signalling a continuation in expanding market breadth and allowing the Barometer Team to redeploy accumulated cash in various portfolios.

NYSE Bullish %

As we sit today, it is important to note that the very clear leadership that had been leading the market coming into the correction is leading the rally coming out. In a structural bull market leadership should be clear and persistent. This can be frustrating for those trying to buy “broken getting fixed” or laggards as opposed to “good getting better”…leadership. New relative strength highs before the correction in the strongest momentum stocks have resolved to higher relative highs post the correction

The message….Stick with established leadership until clear signs of change!

The common characteristic in today’s market is Reflation. The market’s signalling is that we have moved from disinflation to reflation and lessons learned during 35 years of falling rates all have to be questioned….A Costanza moment!

This could last a while.

https://media.giphy.com/media/1VDOxgkEpkUSs/giphy.gif

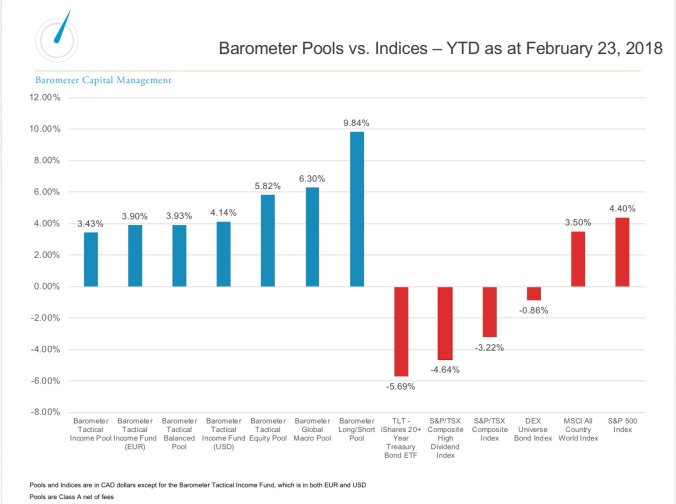

The combination of targeted focus on clear leadership, hedging and timely redeployment have been a significant contributor to a strong start to 2018 from a risk adjusted returns standpoint.

Great comment Dave. Thoughts on the lagging of Canada vs S&P?

LikeLiked by 1 person